A New Kind of Wealth: Gen Z Is Rewriting the Rules

For decades, economic success complied with a familiar pattern: make steadily, save boldy, buy a home, and prepare for retirement. However Gen Z is coming close to cash with a fresh perspective. Instead of concentrating solely on long-lasting build-up, this generation is focusing on equilibrium, well-being, and intentional living.

This shift has actually generated the concept of soft conserving. It's not about abandoning financial goals however redefining them. Gen Z intends to live well today while still bearing in mind tomorrow. In a globe that really feels increasingly uncertain, they are selecting satisfaction now rather than postponing joy for years.

What Soft Saving Really Means

Soft saving is a mindset that values emotional wellness alongside economic duty. It mirrors an expanding belief that money ought to support a life that really feels purposeful in the here and now, not simply in the distant future. Rather than pouring every added buck into savings accounts or retired life funds, several young people are choosing to spend on experience, self-care, and individual advancement.

The rise of this viewpoint was accelerated by the international occasions of recent years. The pandemic, financial instability, and altering work characteristics triggered many to reassess what genuinely matters. Faced with changability, Gen Z began to welcome the idea that life need to be appreciated in the process, not following reaching a financial savings goal.

Psychological Awareness in Financial Decision-Making

Gen Z is approaching cash with emotional recognition. They want their monetary selections to line up with their worths, mental health and wellness, and lifestyle ambitions. Rather than consuming over typical criteria of wide range, they are seeking function in just how they earn, spend, and save.

This could resemble spending on mental wellness sources, funding innovative side projects, or focusing on adaptable living arrangements. These options are not impulsive. Rather, they mirror an aware effort to craft a life that supports happiness and stability in a manner that really feels genuine.

Minimalism, Experiences, and the Joy of Enough

Several youngsters are averting from consumerism for minimalism. For them, success is not regarding having a lot more yet concerning having sufficient. This connections straight right into soft financial savings. As opposed to gauging wide range by product properties, they are concentrating on what brings real happiness.

Experiences such as traveling, shows, and time with friends are taking precedence over deluxe things. The change shows a deeper desire to live totally as opposed to gather constantly. They still save, but they do it with intention and equilibrium. Saving is part of the strategy, not the whole focus.

Digital Tools and Financial Empowerment

Innovation has played a significant function in shaping just how Gen Z engages with money. From budgeting applications to financial investment platforms, electronic tools make it easier than ever before to stay educated and take control of personal finances.

Social media site and on the internet communities additionally influence just how monetary top priorities are set. Seeing others build versatile, passion-driven careers has actually encouraged lots of to seek similar way of livings. The ease of access of economic info has actually empowered this generation to develop strategies that help them rather than complying with a traditional course.

This increased control and understanding are leading several to look for relied on specialists. As a result, there has been an expanding passion in services like wealth advisors in Tampa that comprehend both the technological side of financing and the psychological motivations behind each choice.

Safety Through Flexibility

For past generations, monetary stability commonly implied adhering to one job, acquiring a home, and following a dealt with plan. Today, security is being redefined. Gen Z sees flexibility as a type of protection. They value the ability to adjust, pivot, and discover multiple earnings streams.

This redefinition includes exactly how they seek economic guidance. Numerous want approaches that think about job changes, gig work, imaginative objectives, and transforming family dynamics. Instead of cookie-cutter recommendations, they desire tailored assistance that fits a vibrant lifestyle.

Professionals who provide insight into both planning and adaptability are ending up being progressively useful. Solutions like financial planning in Tampa are developing to consist of not just traditional investment recommendations yet also methods for keeping economic wellness during transitions.

Realigning Priorities for a Balanced Life

The soft cost savings pattern highlights a vital change. Gen Z isn't overlooking the future, but they're choosing to live in a way that doesn't sacrifice joy today. They are seeking a middle course where temporary satisfaction and lasting security exist side-by-side.

They are still buying retired life, settling financial obligation, and building cost savings. However, they are also including leisure activities, traveling, downtime, and rest. Their version of success is broader. It's not just about total assets however regarding living a life that feels abundant in every feeling of the word.

This viewpoint is website urging a wave of modification in the financial solutions market. Advisors who focus only on numbers are being replaced by those who recognize that values, identification, and feeling play a central duty in monetary choices. It's why a lot more individuals are turning to asset management in Tampa that takes an all natural, lifestyle-based strategy to wide range.

The brand-new requirement for monetary wellness blends technique with empathy. It pays attention to what individuals really want out of life and builds a strategy that sustains that vision.

Comply with the blog for more understandings that show reality, modern cash routines, and exactly how to grow in manner ins which really feel both useful and personal. There's even more to check out, and this is only the start.

Scott Baio Then & Now!

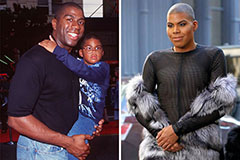

Scott Baio Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!